|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

|

|

|

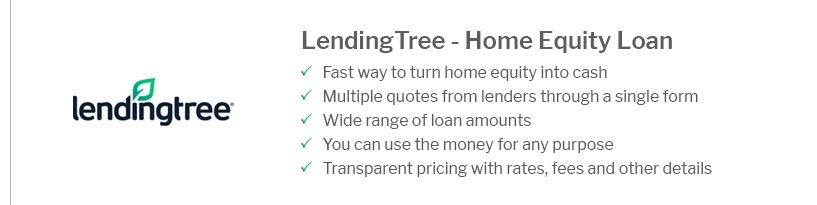

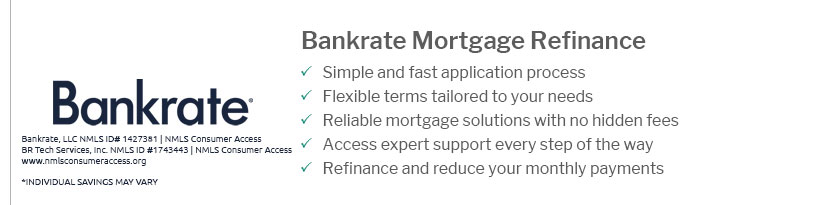

Understanding Reputable Refinance Companies for Your Financial NeedsWhen considering refinancing, selecting a reputable company is crucial to secure favorable terms. This article delves into the characteristics of reputable refinance companies and how to identify them. Characteristics of Reputable Refinance CompaniesTrustworthy refinance companies exhibit certain characteristics that set them apart from less reliable firms. Transparent CommunicationTransparency in terms and conditions is a hallmark of reputable companies. They ensure clients are well-informed about interest rates, fees, and any other financial implications involved in the refinancing process. Strong Customer ServiceReputable companies prioritize customer service, offering support and guidance throughout the refinancing process. This helps build trust and ensures a smooth transition.

Advantages and Disadvantages of RefinancingUnderstanding the pros and cons of refinancing can help make an informed decision. Advantages

Disadvantages

For those with credit challenges, exploring best home refinance for bad credit options can provide tailored solutions. How to Choose the Right Refinance CompanySelecting the right refinance company involves careful consideration of various factors. Research and ReviewsResearching potential companies and reading customer reviews can provide insights into their reliability and service quality. Comparative AnalysisComparing offerings from different companies helps identify the best home refinance interest rates available in the market. FAQWhat factors should I consider when choosing a refinance company?Key factors include interest rates, customer service, transparency of terms, and customer reviews. How can I ensure a company is reputable?Look for accreditation, check reviews, and ensure they offer clear communication and strong customer support. https://moneyzine.com/mortgages/best-refinance-companies/

10 Best Lenders to Refinance Mortgage in 2023 - SoFi Best for online application process. - New American Funding Best overall. - PNC Bank Best for borrowers ... https://hardmoneyloansolutions.com/best-loan-companies-for-refinance/

Best Places To Refinance a Home Loan ; 1, Rocket Mortgage, Fully online refinancing ; 2, loanDepot, Quality customer service ; 3, Truist, Refinance ... https://reliancefinancial.com/best-mortgage-refinance-companies-in-california/

We have compiled this list based on reputation and customer satisfaction rates so it should be easy enough to decide who is right for your needs.

|

|---|